Extra one time payment mortgage calculator

20 years 6 months. 60000 one-time payment Monthly Payment PI Pay-off Time.

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Extra Payment Mortgage Calculator.

. To calculate how long it will take for the mortgage holder to pay off the average mortgage set up the calculator this way. Original Payment Lump-Sum Payment. Now one more time reenter the extra 200 payment amount and recheck the investment schedule located after the loan schedule.

Theres a lot more to know about a mortgage than just the payment amount. A mortgage is a legal instrument of the common law which is used to create a security interest in real property held by a lender as a security for a debt usually a mortgage loan. According to the Mortgage Bankers Association the average size of new 30-year mortgages in the US.

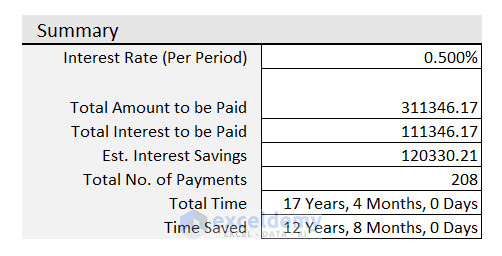

The calculator lets you determine monthly mortgage payments find out how your monthly yearly or one-time pre-payments influence the loan term and the interest paid over the life of the loan and see complete. You can save a lot of interest if you pay down the loan earlyThis extra payment calculator is designed to tell you how much interest and time. Extra Payment Mortgage Calculator By making additional monthly payments you will be able to repay your loan much more quickly.

Bi-Weekly Mortgage Payment Calculator Terms Definitions. Note that you can add up to 5 one-time payments. When you take out a mortgage you can take points to adjust your mortgage rate.

The calculator is quite flexible. However borrowers need to understand the. You see that she can add any amount of extra payment to her regular monthly and regular extra recurring one payment.

If you plan to stay in your house for a short time like 5 to 7 years then you might be better off focusing your money in some other investment. Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculatorWhen you pay extra on your principal balance you reduce the amount of your loan and save money on interest. This free online calculator will show you how much you will save if you make 12 of your mortgage payment every two weeks instead of making a full mortgage payment once a month.

Yearly or one-time then click Apply Extra Payments to see how. The most common loan terms are 30-year fixed-rate mortgages and 15-year fixed-rate mortgagesDepending on your financial situation one term may be better for you than the other. Calculate mortgage payoff savings from one-time andor reoccurring extra payments.

Most people use a mortgage calculator to estimate the payment on a new mortgage but it can be used for other purposes too. Hypothec is the corresponding term in civil law jurisdictions albeit with a wider sense as it also covers non-possessory lien. In the loan summary part.

This wont change your monthly payment. There are three main types of points you should consider before closing a mortgage deal. Use the above mortgage over-payment calculator to determine your potential savings by making extra payments toward your mortgage.

Using my Mortgage Payoff Calculator Extra Payment. The multiple extra payments can be for 2 or any number up until the loan is paid-in-full. Even just an extra payment.

To interest savings wanting to sell their home or refinancing. No matter what make. With a 30-year fixed-rate mortgage you have a lower monthly payment but youll pay more in interest over time.

Extra Mortgage Payments Calculator. You dont have to pay a lot of extra each month to make a significant difference in your loan payoff time. And she will be able to repay her loan completely in 11 years 4 months and 0 days.

Maintain these additional payments over an extended period of time and youll likely eliminate several years from your term. You can do this by making a one-time payment towards the principal balance. PMI is an extra cost added to your monthly payment that doesnt go toward paying off your mortgage.

Meanwhile there are 52 weeks in a year. Savings in a matter of seconds and persuade yourself to bite the bullet and pay more every time you receive your car or mortgage loan statement. Our calculator can factor in monthly annual or one-time extra payments.

A mortgage in itself is not a debt it is the lenders security for a debt. Keep in mind that you may pay for other costs in your monthly payment such as homeowners insurance property taxes and private mortgage insurance PMI. Whatever the frequency your future self will thank you.

If no one-time extra payment is desired leave blank or enter a zero. One percent of a loan is equivalent to 1 point. The calculator lets you find out how your monthly yearly or one-time pre-payments influence the loan term and the interest paid over the life of the loan.

If youre a first-time home buyer a smaller down payment of 510 is okay toobut then you will have to pay PMI. Thats one extra monthly payment a year. Simply select the number of one-time payments you would like to make.

The net effect is just one extra mortgage payment per year but the interest savings can be dramatic. If you would like to make multiple payments for ranges of time you can enter multiple one-time payments or other periodic payment types by clicking on the Add Payment link. You can also make one-time payments toward your principal with your yearly bonus from work tax refunds investment dividends or insurance payments.

Make payments weekly biweekly semimonthly monthly bimonthly quarterly or. These are discount points origination points and negative points. In effect you will be making one extra mortgage payment per year -- without hardly noticing the additional cash outflow.

In addition if you use an accelerated biweekly payment plan you can remove almost 5 years off a 30-year mortgage. It could be one extra mortgage payment a year two extra mortgage payments a year or an extra payment every few months. As mentioned elsewhere the calculator allows for a one-time extra payment or for multiple extra payments.

Is approaching 400000 and interest rates are hovering around 3. Mortgage Amount or current balance. Save up a down payment of at least 20 so you wont have to pay private mortgage insurance PMI.

If you pay every 2 weeks thats 26 half payments. Put in any amount that. You could add 360 extra one-type payments or you could do an extra monthly payment of 50 for 25 years and then an extra monthly payment.

Calculate mortgage payment amount term interest rate or loan amount. Extra Payment Mortgage Calculator. Use this additional payment calculator to determine the payment or loan amount for different payment frequencies.

The calculator prepares an investment schedule only if you have entered an extra payment amount AND if the option Include the Investment Schedule is set to Yes. Extra Mortgage Payment Calculator 47. Use our free Extra Payment Calculator to find out just how much money you are saving in interest by making extra payments on your auto home or other installment loans.

Free mortgage calculator to find monthly payment total home ownership cost and amortization schedule with options for taxes PMI HOA and early payoff. As a result by the end of the year youll pay an equivalent of 13 monthly payments. Adding just one extra payment a month will help you be mortgage-free sooner and save you potentially thousands in interest.

9 years 6 months. An additional 50 or even 25 extra principal each month may make a surprising difference.

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Extra Payment Mortgage Calculator For Excel

Mortgage With Extra Payments Calculator

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Downloadable Free Mortgage Calculator Tool

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Mortgage Payoff Calculator With Line Of Credit

Downloadable Free Mortgage Calculator Tool

Extra Payment Calculator Is It The Right Thing To Do

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Free Balloon Loan Calculator For Excel Balloon Mortgage Payment